Accelerating Financial Access

Designing Thailand’s Fastest Personal Loan Experience with Seamless User Journeys

Role & Responsibility

Lead UX/UI, Researcher, Interaction Design, Prototyping

Industry

Financial Service

Year

2021

Project Vision

Giving fast credit access to those in need, fighting the shark loan market, and educate the users and help them make wiser financial decisions.

The scenario

It’s been a tough time for lots of people in the Covid situation, and money is one of the biggest problems. In Thailand the government and the banks offer some solutions to help people, but they need something faster and more effective. This is where we will provide a solution.

The main goal is to give fast credit access to those in need, eliminate the loan shark market, and educate users so they can make wiser financial decisions.

Problem

Traditional lending companies do not serve the underbanked and unbanked sections of society. This group of people, who are extremely vulnerable to predatory lending practices and internet scams, are forced to take out loans from loan sharks with daily interest rates exceeding 20%.

The money lending applications on the market can take days for users to their loan and it's not an easy process as the application process requires many documents to identify their credibility.

Pain Points

Found the negative feedback about the truth if borrow money from the app is existing or how trustworthy is it will be Users still think the only secure way is to borrow money with the bank The registration form requires too much information User worry about the data security with an unapproved case after registered the app

Competitive Analysis

There are quite a few others that have the same idea: I evaluated each platform’s features, design, and brand tone, discovering two main factors that can be used to compare them:

Ease register process (Onboarding)

Trustworthiness

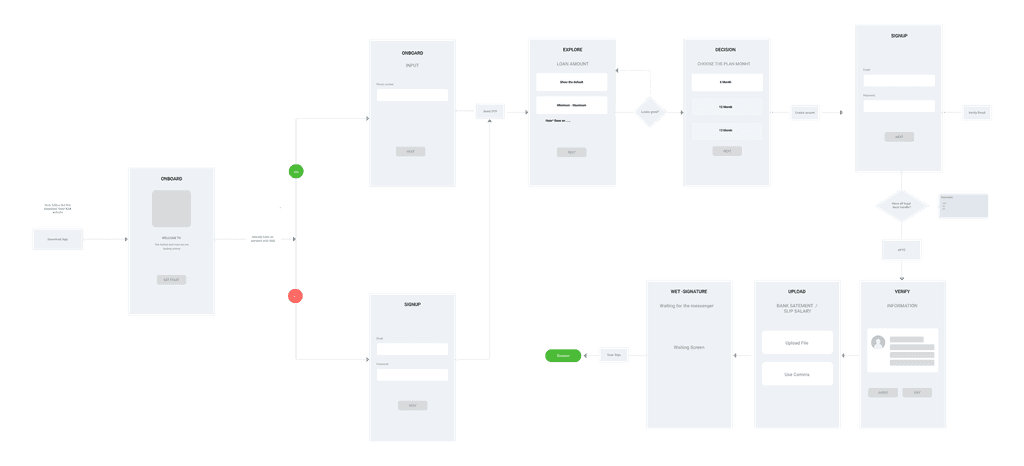

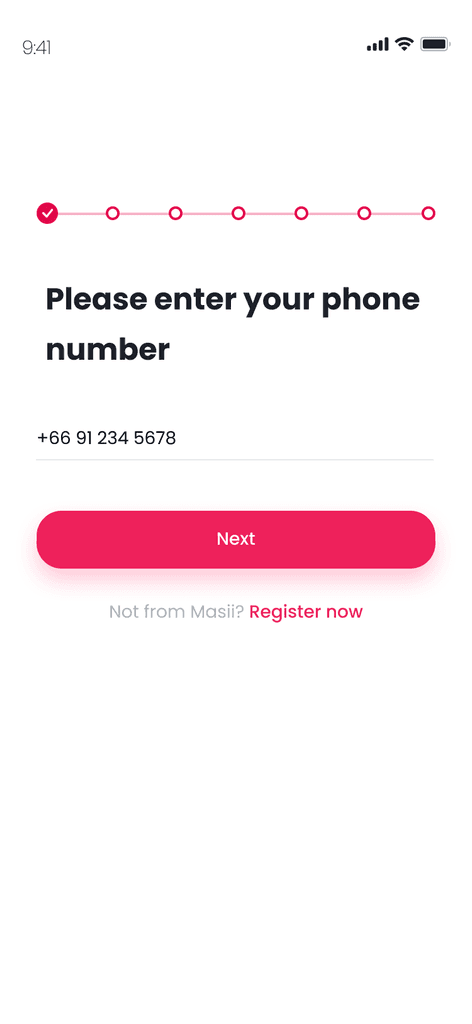

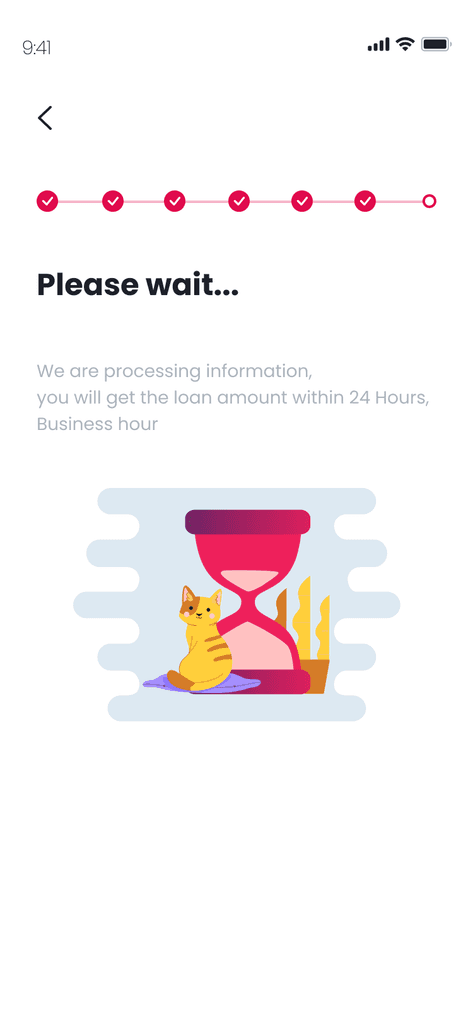

User Flow

I developed a clear and efficient user flow that streamlined the entire user journey from start to finish. By refining each step through iterative feedback, we ensured a more intuitive and seamless experience, ultimately reducing friction and improving user engagement

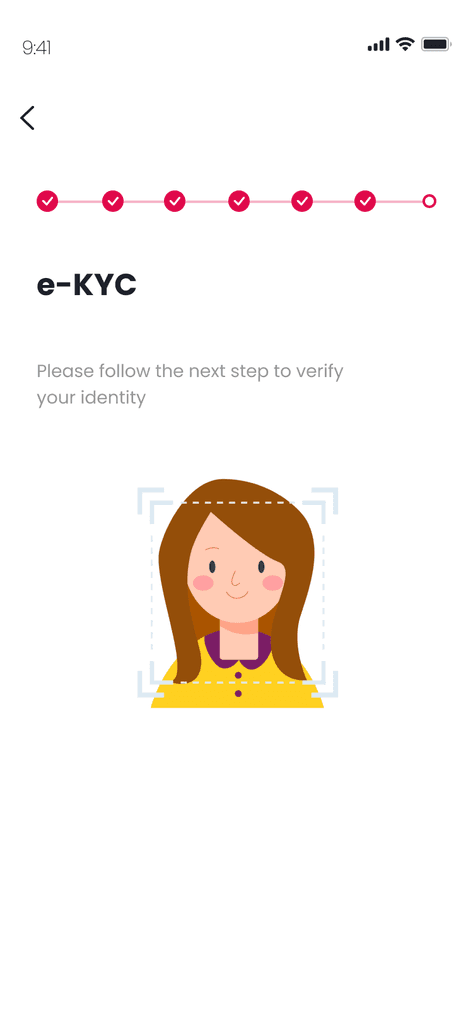

LoFi (Onboarding)

Creating a low-fidelity (LoFi) prototype for the onboarding process began with a deep understanding of our target users—individuals with limited technological proficiency and lower educational backgrounds

Conclusion

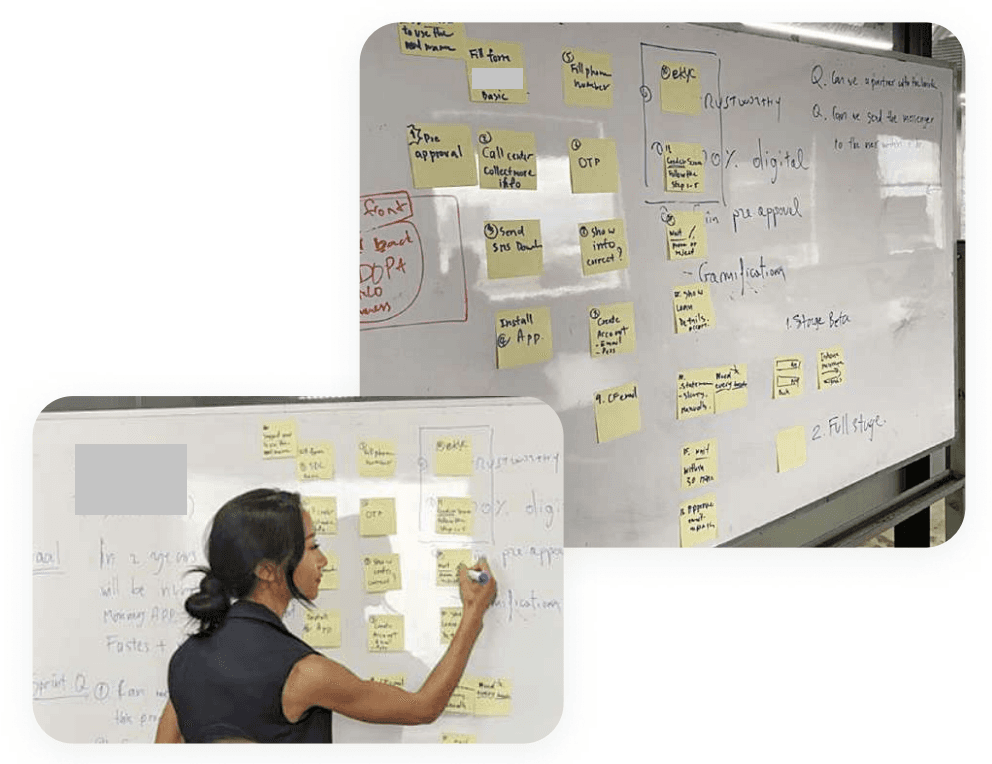

During my 3 weeks of research, working on user personas, user journey, user flow, wire-framing, and prototyping I received feedback from the stakeholders in every sprint. The feedback on the target user personas and in terms of the design were very positive.

We focused on a visually appealing design and tested the clickable prototype with some users. I received more feedback from the users that more clearly defined the end design goals. This allowed me to implement a new design before getting to the final test or call-it-done version that the developers are working on

Next Step

After the user receives their desired loan it will show our app serves it's purpose. In the next phase we will focus on the re-payment, which is crucial in keeping users on the app. Another goal is is to educate users to be better at financial management within the education center.